Imagine this: You’re about to buy groceries, but your card gets declined. You check your account balance and it’s way lower than you expected! What happened?

You might have a checking account balance error. Don’t worry, it happens more often than you think. This article will show you how to find those sneaky errors and fix them.

What is a Checking Account Balance Error?

A checking account balance error is when the money you think you have in your account doesn’t match the bank’s records. It can be a simple math mistake, an incorrect transaction, or even something more serious like fraud.

Why is Finding Checking Account Balance Errors Important?

Finding errors quickly is important for a few reasons:

- Avoid Overdraft Fees: If your account balance is lower than you think, you might accidentally overdraw your account and get hit with hefty fees.

- Catch Fraudulent Activity: Errors can sometimes be a sign that someone has accessed your account without your permission.

- Keep Your Finances in Order: Knowing your true balance helps you budget better and avoid money problems.

How to Find a Checking Account Balance Error: A Step-by-Step Guide

Finding a checking account balance error can seem like searching for a needle in a haystack, but with a systematic approach, it can be a lot easier. Here’s a step-by-step guide to help you become a balance detective:

Gather Your Bank Statements

Your bank statement is your best friend in this process. It has a record of all your transactions, including deposits, withdrawals, and fees. You can usually find your statements online, or you can have the bank mail them to you. Get at least the last two months of statements to get a good overview.

Check Your Recent Transactions

Go through your statement line by line and compare it with your own records (receipts, online purchases, etc.). Look for anything that looks unfamiliar or incorrect. Here are some common things to watch out for:

- Unrecognized Transactions: Do you see any purchases you don’t remember making?

- Duplicate Transactions: Was your card charged twice for the same purchase?

- Incorrect Amounts: Does the amount on your statement match the amount on your receipt?

- Missing Deposits: Did you deposit a check that isn’t showing up in your account?

- Unexpected Fees: Are there any fees that you don’t understand?

Use Your Bank’s Online Tools

Most banks have online tools that can help you find errors. These tools might include:

- Transaction Search: Search for specific transactions by date, amount, or merchant.

- Spending Trackers: See how much you’re spending in different categories.

- Account Alerts: Set up alerts to notify you of unusual activity.

Reconcile Your Account

Account reconciliation means comparing your bank statement with your own records to make sure they match. This may seem old-fashioned, but it’s a very effective way to find errors. Here’s how to do it:

- Get a Reconciliation Worksheet: Many banks provide these, or you can create your own.

- Compare Transactions: Check off each transaction in your register that appears on your statement.

- Identify Differences: Note any transactions that are in your register but not on your statement, or vice versa.

- Investigate Discrepancies: Figure out why there are differences. Did you forget to record a transaction? Is there a bank error?

Contact Your Bank

If you’ve found an error that you can’t explain, it’s time to contact your bank. Be prepared to provide them with the following information:

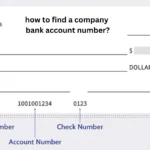

* **Your Account Number**

* **The Date of the Error**

* **The Amount of the Error**

* **A Description of the Error**

The bank will investigate the error and hopefully correct it.

Common Types of Checking Account Balance Errors

Here are some of the most common culprits behind those frustrating balance discrepancies:

- Mathematical Errors: Simple addition or subtraction mistakes can happen, either by you when recording transactions or by the bank when processing them.

- Transaction Errors: These can include things like being charged the wrong amount for a purchase, having your card charged twice for the same item, or having a deposit credited to the wrong account.

- Timing Differences: Sometimes there can be a delay between when a transaction is made and when it posts to your account. This can make it seem like you have more or less money than you actually do.

- Fees: Banks can charge a variety of fees, such as monthly maintenance fees, overdraft fees, or ATM fees. Make sure you understand all the fees associated with your account.

- Fraudulent Activity: This is the most serious type of error and can include unauthorized purchases, ATM withdrawals, or even identity theft.

Tips to Avoid Checking Account Balance Errors

While some errors are unavoidable, there are things you can do to minimize the risk:

- Track Your Spending: Keep a record of all your transactions, either in a check register or using a budgeting app.

- Review Your Statements Regularly: Don’t just let your bank statements pile up! Go through them carefully at least once a month.

- Set Up Account Alerts: Many banks allow you to set up alerts to notify you of certain activity, such as low balances, large withdrawals, or suspicious transactions.

- Use Strong Passwords: Protect your online banking account with a strong password and change it regularly.

- Be Careful When Using ATMs: Only use ATMs in safe, well-lit locations and be aware of your surroundings.

How to Protect Yourself from Fraud

Fraudulent activity can lead to significant financial losses and headaches. Here are some tips to help you stay safe:

- Monitor Your Account Regularly: Check your account balance and transactions frequently, even daily if possible.

- Sign Up for Fraud Alerts: Many banks offer fraud alerts that will notify you of any suspicious activity on your account.5

- Be Careful What You Share Online: Don’t share your account number, password, or other sensitive information online or over the phone.

- Use Strong Passwords: Create strong, unique passwords for all your online accounts and change them regularly.

- Report Suspicious Activity Immediately: If you see any unauthorized transactions or suspect fraud, contact your bank immediately.

What to Do If You Suspect Fraud

If you believe you’ve been a victim of fraud, take these steps:

- Contact your bank immediately: Report the fraudulent activity and ask them to block your account.

- Change your online banking password: Choose a new, strong password that is different from your old one.

- File a police report: This will create a record of the fraud and may be helpful for insurance purposes.

- Review your credit report: Check your credit report for any unauthorized activity. You can get a free copy of your credit report from each of the three major credit bureaus6 (Equifax, Experian, and TransUnion) once a year.

Keeping Your Account Safe and Error-Free

| Tip | Description |

|---|---|

| Track Your Spending | Use a check register, budgeting app, or spreadsheet. |

| Review Statements Regularly | Check your statements at least once a month for any errors or suspicious activity. |

| Set Up Account Alerts | Get notified of low balances, large withdrawals, or suspicious transactions. |

| Use Strong Passwords | Protect your online banking with a strong, unique password. |

| Be Careful at ATMs | Use ATMs in safe locations and be aware of your surroundings. |

| Monitor Your Account Regularly | Check your balance and transactions frequently. |

| Sign Up for Fraud Alerts | Get notified of suspicious activity on your account. |

| Be Careful What You Share Online | Protect your account information. |

| Report Suspicious Activity Immediately | Contact your bank right away if you suspect fraud. |

Understanding Your Bank’s Error Resolution Process

| Step | Description |

|---|---|

| Report the Error | Contact your bank and provide details about the error. |

| Bank Investigates | The bank will review your claim and investigate the error. |

| Resolution | The bank will correct the error or explain why they believe there is no error. |

| Time Frame | The bank generally has a certain number of days to investigate and resolve the error. |

| Dispute the Bank’s Decision | If you disagree with the bank’s decision, you may be able to escalate the dispute to a higher authority, such as a consumer protection agency. |

By following these tips and being vigilant, you can significantly reduce your risk of encountering checking account balance errors and keep your hard-earned money safe.

Conclusion

Finding a checking account balance error can be a frustrating experience, but it’s important to remember that you’re not alone. By following the steps outlined in this guide, you can become a master at identifying and resolving discrepancies. Remember to keep accurate records, review your statements regularly, and utilize your bank’s online tools to stay on top of your finances.

And if you ever suspect fraud, don’t hesitate to contact your bank immediately. With a little effort and attention to detail, you can ensure that your checking account balance is always accurate and that your money is safe and sound.

FAQs

Can I dispute a bank error if I disagree with their decision?

Yes, you can usually dispute a bank’s decision if you have evidence to support your claim. Contact a consumer protection agency for assistance.

What should I do if I notice a transaction I don’t recognize?

If you see an unfamiliar transaction, contact your bank immediately to report it. They can help you determine if it’s fraudulent and take necessary action.

How often should I reconcile my checking account?

It’s a good practice to reconcile your account at least once a month to catch any errors or discrepancies.

Is it safe to use online banking to check my account balance?

Yes, online banking is generally safe as long as you use strong passwords and are cautious about sharing personal information.

What are some common signs of fraudulent activity on my checking account?

Common signs of fraud include unauthorized transactions, unexpected withdrawals, and changes to your account information that you didn’t make.