Imagine this: You’re online, ready to pay a bill or set up direct deposit, and the website asks for your checking account number. You grab your checkbook, but then you freeze. All those numbers! Where is the checking account number hiding?

Don’t worry, we’ve all been there. Finding your checking account number on a check might seem confusing at first, but it’s actually quite simple once you know what to look for. This guide will walk you through the process step-by-step, using clear explanations and helpful images. By the end, you’ll be a check-reading pro!

Understanding Your Check: More Than Just a Piece of Paper

Before we hunt down that checking account number, let’s take a moment to understand what information a check holds. A check is like a mini-document with important details that help your money travel safely to the right place. Think of it as a map guiding your payment to its destination!

Here’s a quick overview of the key elements you’ll find on a check:

- Your Name and Address: This tells everyone who is sending the money.

- Check Number: Like a serial number, each check has a unique number to keep things organized.

- Bank Name and Address: This shows which bank holds your account.

- Routing Number: This 9-digit code identifies your bank. It’s like your bank’s zip code!

- Checking Account Number: This is your personal account’s ID within the bank.

- Memo Line: A space for you to write a note about the payment.

- Signature Line: This is where you sign to authorize the payment.

Now that you have a general idea of what’s on a check, let’s focus on finding that checking account number!

How to Find Your Checking Account Number on a Check

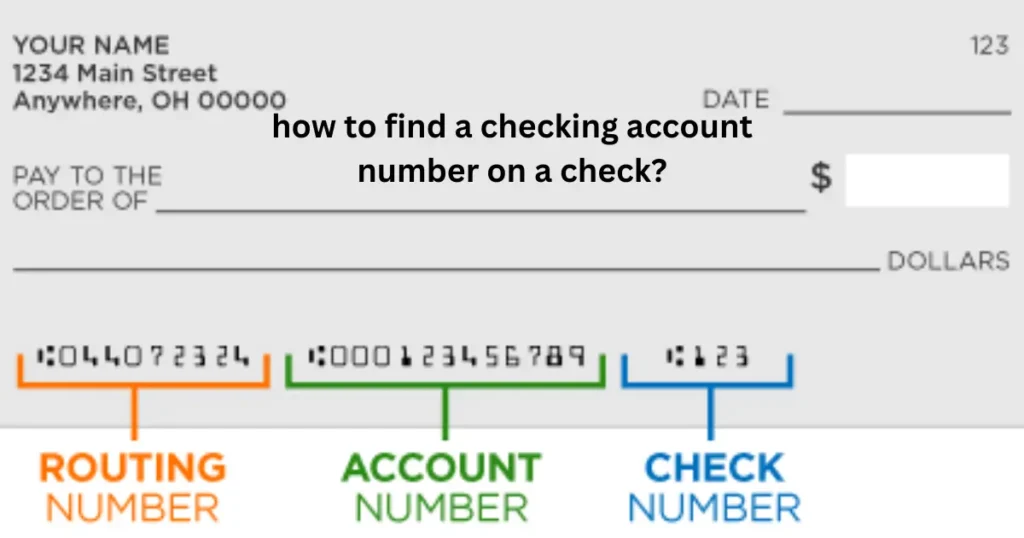

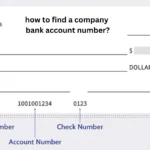

Your checking account number is located at the bottom of your check, printed among a series of numbers. To help you pinpoint it, let’s break down the number sequence:

The Three-Part Code at the Bottom of Your Check

At the bottom of your check, you’ll see a line of numbers printed in a special font. This line is made up of three sets of numbers separated by symbols called MICR lines (those funny-looking characters).

Here’s what each set of numbers represents:

- Routing Number: The first 9-digit number identifies your bank.

- Checking Account Number: This is the number you’re looking for! It comes after the routing number. The length of this number can vary depending on your bank.

- Check Number: The final number in the sequence matches the check number printed in the top right corner of your check.

To make this clearer, let’s look at a visual example.

Tips for Identifying Your Checking Account Number

- Look for the MICR Line Symbols: The checking account number is nestled between these unique characters.

- Varying Lengths: Remember, checking account numbers can be different lengths depending on the bank. Don’t worry if yours seems shorter or longer than you expect.

- Contact Your Bank: If you’re still unsure, your bank can always confirm your account number.

Why You Need Your Checking Account Number

Knowing your checking account number is essential for various banking tasks. Here are some common situations where you’ll need it:

- Setting up Direct Deposit: Provide your checking account number to your employer to have your paycheck deposited directly into your account.

- Paying Bills Online: Many online bill pay services require your checking account number to process payments.

- Making Online Transfers: Transfer money between your accounts or to others using your checking account number.

- Receiving Wire Transfers: Give your checking account number and routing number to someone who wants to send you money electronically.

- Ordering Checks: You’ll need your checking account number to order new checks.

Keeping Your Checking Account Number Safe

Your checking account number is sensitive information, so it’s important to keep it secure. Here are some tips to protect yourself:

- Store Checks Securely: Keep your checkbook in a safe place, like a locked drawer or filing cabinet.

- Shred Old Checks: Before discarding old checks, shred them to prevent anyone from accessing your account information.

- Be Cautious Online: Only share your checking account number on secure websites (look for “https” in the address bar).

- Monitor Your Account Regularly: Review your bank statements frequently for any unauthorized transactions.

- Report Suspicious Activity: If you notice anything unusual on your account, contact your bank immediately.

Using Your Checking Account Number Wisely: A Recap

We’ve covered a lot! Let’s recap the key takeaways:

- Your checking account number is a crucial piece of information found at the bottom of your check.

- It’s part of a three-part code, positioned between the routing number and the check number.

- You’ll need this number for various banking activities, from setting up direct deposit to paying bills online.

- Always prioritize the security of your checking account number.

By understanding how to locate and protect your checking account number, you can confidently manage your finances and ensure smooth transactions. Remember, your check is more than just a piece of paper – it’s a tool to manage your money effectively!

FAQs

How do I find my checking account number if I don’t have a check?

If you don’t have a check handy, there are a few other ways to find your checking account number:

- Online Banking: Log in to your online banking account and look for your account details.

- Bank Statement: Your checking account number is printed on your monthly bank statement.

- Mobile Banking App: Many banking apps display your account number.

- Contact Your Bank: Call your bank’s customer service line and they can provide your account number after verifying your identity.

Is my checking account number the same as my debit card number?

No, your checking account number and debit card number are different. Your debit card number is linked to your checking account, but it’s a separate number used specifically for card transactions.

What should I do if I accidentally give someone my checking account number?

If you accidentally share your checking account number with someone you don’t trust, contact your bank immediately to report the situation. They may advise you to close your current account and open a new one to prevent any unauthorized access.

Can I find my checking account number by searching my bank’s website?

While some banks may display your account number when you log in to online banking, it’s generally not possible to find your checking account number simply by searching the bank’s website. This is a security measure to protect your personal information.

What is the difference between a routing number and a checking account number?

The routing number identifies your bank, while the checking account number identifies your specific account within that bank. Both numbers are necessary for transactions like direct deposit and online bill pay.