Imagine you’re about to buy something online. You’ve found the perfect item, added it to your cart, and are ready to pay. But wait! The website asks for your checking account verification number, and you have no idea where to find it. Don’t worry, it happens to many of us.

This article will show you exactly how to find that number, so you can finish your purchase and get back to more important things.

What is a Checking Account Verification Number?

Before we start searching, let’s understand what this number actually is. A checking account verification number is like a special code that confirms your bank account is real and that you’re allowed to use it.

It’s a security measure to prevent fraud and keep your money safe. This number might also be called a routing number or an account number, depending on what you need it for.

Why You Might Need Your Checking Account Verification Number

You usually need this number for things like:

- Setting up direct deposit: This lets your employer put your paycheck directly into your account.

- Paying bills online: Instead of writing checks, you can use your account number to pay bills through your bank’s website or a bill pay service.

- Making online purchases: Some websites allow you to pay directly from your checking account.

- Transferring money between accounts: You’ll need the number to move money between your own accounts or to send money to someone else.

Now that you know what it is and why you need it, let’s find it!

How to Find Your Checking Account Verification Number

There are a few different places where you can find your checking account verification number. Let’s look at the most common ones:

Check Your Checkbook

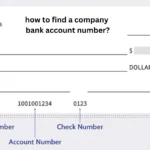

If you have a checkbook, the easiest way to find your account information is to look at one of your checks. You’ll see a set of numbers printed at the bottom. These numbers are usually in a special font called MICR (Magnetic Ink Character Recognition), which helps banks process checks quickly. Here’s what each set of numbers means:

| Number Set | Description |

|---|---|

| First nine digits | Routing number: This identifies your bank. |

| Second set | Account number: This is your unique checking account number. |

| Third set | Check number: This is the number of the specific check. |

Log in to Your Online Banking

Most banks have online banking platforms where you can access your account information. Here’s how you can usually find your verification number online:

- Find your account details: Log in to your bank’s website or app. Look for a section called “Account Details,” “Account Summary,” or something similar.

- Look for the number: Your account number and routing number will be listed there.

Review Your Bank Statements

Your monthly bank statement also contains your account information. Look for a section that lists your account details, and you should find your account number and routing number there.

Contact Your Bank

If you’re having trouble finding your checking account verification number, don’t hesitate to contact your bank directly. They can provide you with the information you need. You can usually reach them by:

- Calling customer service: The phone number is usually on the back of your debit card or on the bank’s website.

- Visiting a branch: A bank teller can help you find your account information.

- Sending a secure message: Many online banking platforms have a secure messaging feature you can use to contact customer service.

Tips for Finding Your Checking Account Verification Number

Here are a few extra tips to help you in your search:

- Know what you’re looking for: Sometimes, the number might be labeled differently. Look for terms like “account number,” “routing number,” “bank code,” or “transit number.”

- Keep your information secure: Never share your checking account verification number with anyone you don’t trust.

- If you’re unsure, ask for help: It’s always better to be safe than sorry. If you’re not sure where to find the number or if you think your account information might be compromised, contact your bank immediately.

Understanding Your Checking Account Verification Number

Now that you’ve found your checking account verification number, it’s important to understand how to use it safely and responsibly.

- Protect your number: Treat your checking account verification number like you would a credit card number. Keep it confidential and don’t share it with anyone you don’t trust.

- Be cautious online: When making online purchases or paying bills, make sure the website is secure. Look for “https” in the address bar and a padlock icon.

- Monitor your account: Regularly review your bank statements for any unauthorized transactions. If you see something suspicious, report it to your bank immediately.

By following these tips, you can help keep your money safe and avoid becoming a victim of fraud.

Conclusion

Finding your checking account verification number is essential for managing your finances and making transactions. Whether you’re setting up direct deposit, paying bills online, or making purchases, knowing where to find this number is crucial.

Remember to keep your information safe and be cautious when sharing it online. By using the methods outlined in this article and following the safety tips, you can confidently access and use your checking account for all your financial needs.

FAQs

How can I find my checking account number if I don’t have checks?

You can find your checking account number by logging in to your online banking, reviewing your bank statements, or contacting your bank directly.

What should I do if I suspect someone has my checking account verification number?

If you suspect your account information has been compromised, contact your bank immediately to report the situation and take necessary precautions.

Is my checking account number the same as my debit card number?

No, your checking account number is different from your debit card number. They are both unique identifiers linked to your account, but they serve different purposes.

Where can I find my bank’s routing number?

Your bank’s routing number is usually located on your checks, online banking platform, and bank statements. You can also find it on the bank’s website or by contacting customer service.

Can I use my checking account verification number to make international transfers?

For international transfers, you’ll typically need additional information, such as the SWIFT code, in addition to your checking account verification number. Contact your bank for specific instructions on international transfers.