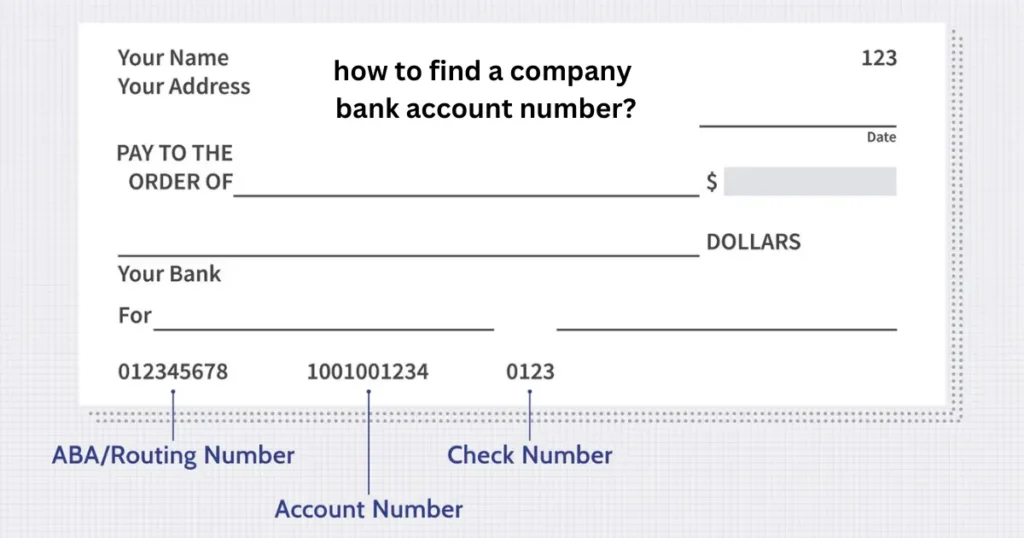

Finding a company’s bank account number can be tricky, but it’s sometimes necessary for legitimate reasons, like paying an invoice or verifying payment details.

This guide offers clear, straightforward methods for how to find a company bank account number, focusing on legal and ethical approaches. We’ll cover various situations and provide helpful tips to make the process easier.

Why You Might Need a Company Bank Account Number

There are several valid reasons why you might need a company’s bank account details. These include:

- Making a Payment: If a company prefers direct bank transfers, you’ll need their bank account number and sort code (or routing number).

- Verifying Payment Information: Sometimes, you might want to confirm that the payment details you have are correct to avoid sending money to the wrong place.

- Setting up Direct Debits: For recurring payments, you’ll need the company’s bank account information to set up a direct debit mandate.

- Business Transactions: In B2B dealings, sharing bank details is standard practice for invoicing and payments.

How to Find a Company Bank Account Number: Acceptable Methods

Let’s look at some common and acceptable ways to find this information:

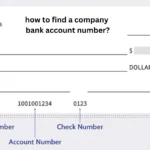

Checking Invoices and Receipts

Invoices and receipts are often the easiest places to find a company’s bank details. Look for a “Payment Details” or “Bank Transfer” section. The information is usually clearly displayed.

Reviewing Contracts and Agreements

If you have a contract or agreement with the company, it might contain their bank account details within the payment terms section.

Contacting the Company Directly

The most straightforward method is to simply ask the company. Contact their accounts department or customer service and explain why you need the information. They should be able to provide it if you have a legitimate reason.

Examining Company Websites

Some companies, particularly larger ones, may publish their bank account details on their website, often in the “Contact Us,” “Payment Information,” or “FAQ” sections.

Checking Publicly Available Information (Limited)

In some jurisdictions, certain business information, including bank details for specific types of businesses, might be publicly accessible. However, this is less common and often restricted to specific situations.

Using Third-Party Payment Platforms

If you’re using a third-party payment platform to transact with the company, they may securely store and display the company’s bank details after you’ve made a transaction with them.

How Not to Find a Company Bank Account Number: Unacceptable Practices

It’s important to be aware of methods that are not acceptable and could even be illegal:

- Attempting to Hack or Phish: Trying to obtain bank details through unauthorized access to a company’s systems is illegal and unethical.

- Social Engineering: Tricking someone into revealing bank details is also unethical and could have legal consequences.

- Purchasing Bank Details from Unreliable Sources: Buying bank details from unauthorized sellers is risky, as the information might be inaccurate or obtained illegally.

Finding Bank Account Details for Different Business Structures

The method for finding bank account details can vary slightly depending on the type of business:

Sole Proprietorships

For sole traders, their personal bank account might be used for business transactions.1 You might find these details on invoices or by contacting them directly.

Partnerships

Partnerships might have a separate business bank account. Again, invoices and direct contact are the best routes to finding this information.

Limited Companies

Limited companies are more likely to have a dedicated business bank account. Their details might be more readily available on official documents or through direct contact.

Acceptable Methods for Finding Company Bank Account Numbers

| Method | Description | Common Use Case |

|---|---|---|

| Invoices and Receipts | Look for a “Payment Details” or “Bank Transfer” section. | Making payments, verifying details |

| Contracts and Agreements | Review payment terms in any existing contracts. | Setting up direct debits, business transactions |

| Contacting the Company | Ask the accounts department or customer service. | All of the above |

| Company Websites | Check “Contact Us,” “Payment Information,” or “FAQ” sections. | Making payments, verifying details |

| Publicly Available Information | Limited availability depending on the jurisdiction and business type. | Specific business types, legal research |

| Third-Party Payment Platforms | If used, they may store and display company’s bank details securely. | Making payments, verifying details |

Unacceptable Methods for Finding Company Bank Account Numbers

| Method | Description | Risk |

|---|---|---|

| Hacking/Phishing | Unauthorized access to systems to steal bank details. | Illegal, unethical, security breach |

| Social Engineering | Tricking someone into revealing bank details. | Unethical, potential legal issues |

| Buying Bank Details | Purchasing bank details from unreliable sources. | Risky, inaccurate information, illegal |

How to Find a Company Bank Account Number: Best Practices

Here are some best practices to follow:

- Always Verify the Information: Double-check any bank details you receive with the company directly.

- Be Cautious of Unsolicited Requests: Be wary of anyone asking for your company’s bank details without a clear and legitimate reason.

- Protect Your Own Bank Details: Never share your company’s bank account details with anyone you don’t trust.

- Keep Records: Keep a record of all bank details you receive and from whom.

How to Find a Company Bank Account Number: Legal Considerations

It’s crucial to obtain bank account information legally and ethically. Unauthorized access or fraudulent activities can have serious consequences. Always ensure you have a legitimate reason for needing the information and obtain it through proper channels.

Conclusion

Finding a company’s bank account number can be done through several legitimate methods, primarily by checking readily available documents like invoices and contracts or simply asking the company directly. It is essential to avoid any methods that are unethical or illegal, such as hacking or social engineering.

By following the best practices outlined in this guide, you can obtain the necessary information safely and responsibly. Remember, when in doubt, always contact the company directly to request the information, ensuring a transparent and secure process.

FAQs

How can I legally find a company’s bank account number?

The most common and legal ways to find a company’s bank account number are by checking invoices, contracts, or contacting the company directly. You may also find it on their website or through a third-party payment platform if you’ve transacted with them before.

Is it illegal to ask a company for their bank account number?

No, it is not illegal to ask a company for their bank account number if you have a legitimate reason, such as making a payment or setting up a direct debit.

What should I do if I suspect someone is trying to obtain my company’s bank details illegally?

If you suspect any unauthorized activity, contact your bank immediately and report the incident to the appropriate authorities.

Where can I find reliable information about a company’s financial details?

Publicly available information about a company’s financial details might be limited. The best source is usually the company itself, either through direct contact or official documents.

How can I verify the bank account details I have received?

Always double-check the bank details you receive with the company directly. Contact their accounts department or customer service to confirm the information before making any payments.