Imagine this: You’re about to pay a bill online, and suddenly you realize you can’t find your account number. Don’t worry, it happens! If you bank with DCU (Digital Federal Credit Union), finding your 11-digit account number is actually pretty easy. This guide will show you exactly where to look, whether you prefer to check online, on paper, or with a little help from DCU.

Understanding Your DCU 11 Digit Account Number

Your DCU account number is like a special code that helps DCU identify your account. It’s always 11 digits long, and you’ll need it for many banking tasks, such as:

- Setting up direct deposit: Your employer needs your account number to send your paycheck directly to your DCU account.

- Making online payments: When paying bills online, you’ll usually need your account number.

- Transferring money: To move money between accounts, you’ll need to provide your account number.

- Contacting customer service: DCU representatives will ask for your account number to quickly access your information and assist you.

Now, let’s look at the different ways to find your 11 digit account number in DCU.

How to Find Your 11 Digit Account Number in DCU Online

DCU offers a convenient online banking platform that makes managing your finances a breeze.1 Here’s how to find your account number online:

Finding Your Account Number Through DCU Online Banking

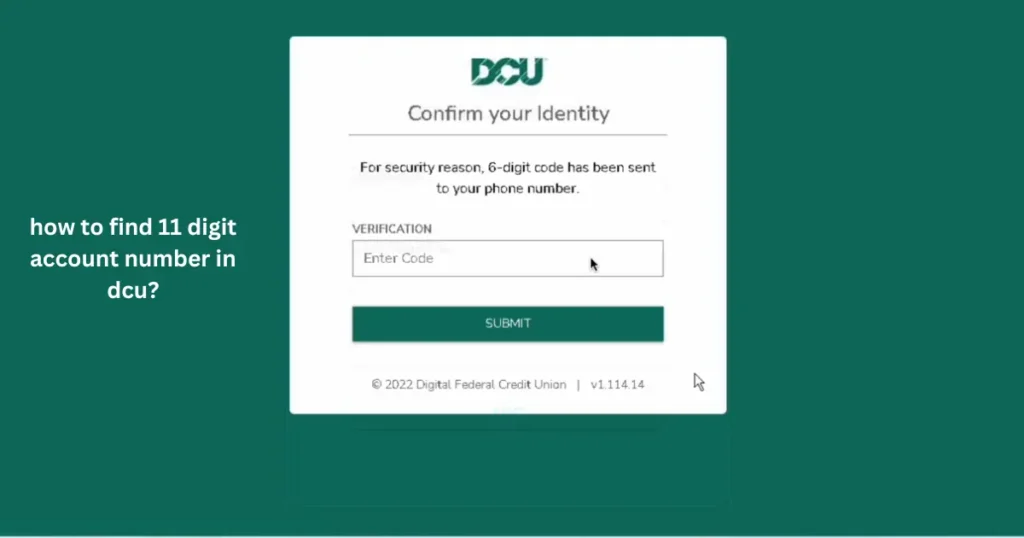

- Log in: Go to the DCU website and log in to your online banking account using your username and password.

- Account Summary: Once logged in, you’ll usually land on your Account Summary page. Look for a section that lists your accounts, such as “My Accounts” or “Account Overview.”

- Locate your account: Find the specific account (checking, savings, etc.) for which you need the number. The 11-digit account number should be displayed clearly near the account name and balance.

Finding Your Account Number on the DCU Mobile App

If you prefer banking on your phone, the DCU mobile app provides quick access to your account number:

- Open the app: Launch the DCU mobile app on your smartphone or tablet.

- Log in: Enter your login credentials to access your account.

- View accounts: Similar to online banking, navigate to the section that displays your accounts.

- Find your number: Your 11-digit account number will be visible alongside your account details.

How to Find Your 11 Digit Account Number in DCU Offline

If you prefer traditional methods or don’t have access to online banking, don’t worry! You can still easily find your DCU account number.

Finding your Account Number on your DCU Statements

Your monthly account statements are a reliable source for finding your account number:

- Locate a statement: Grab a recent paper statement from DCU.

- Find account details: Your 11-digit account number is usually printed at the top of the first page, along with your name and address. It might also be listed in the account summary section.

Finding your Account Number on your DCU Checks

If you have a checking account with DCU, your checks also contain your account number:

- Examine your checkbook: Take out a check from your DCU checkbook.

- Identify the numbers: You’ll see a series of numbers printed at the bottom of the check. Your 11-digit account number is the second set of numbers, located in the middle.

| Location on Check | Description |

|---|---|

| First set of numbers | Routing number (identifies DCU) |

| Second set of numbers | Your 11-digit account number |

| Third set of numbers | Check number |

Other Ways to Find Your DCU Account Number

If you’re having trouble finding your account number or prefer personal assistance, DCU’s customer service team is ready to help.

- Call DCU: Dial the DCU customer service number.

- Verify your identity: Be prepared to answer security questions to confirm your identity.

- Request your account number: Once verified, simply ask the representative for your 11-digit account number.

Visiting a DCU Branch

For in-person assistance, you can visit a DCU branch:

- Find a branch: Locate the nearest DCU branch.

- Bring identification: Take a valid photo ID (driver’s license, passport) with you.

- Speak to a representative: A DCU representative will be able to provide you with your account number after verifying your identity.

Tips for Keeping Your DCU Account Number Secure

- Protect your statements and checks: Store them in a safe place.

- Shred documents: Before discarding any documents containing your account number, shred them properly.

- Be cautious online: Only access your DCU account through the official website or mobile app.

- Use strong passwords: Create a unique and complex password for your online banking.

- Monitor your account: Regularly review your account activity for any unauthorized transactions.

Conclusion

Finding your 11-digit account number in DCU is a straightforward process, with various options available to suit your preferences. Whether you prefer the convenience of online banking, the reliability of paper statements, or the assistance of DCU’s customer service, you can easily locate your account number when needed. Remember to keep your account information secure and reach out to DCU if you require any support.

FAQs

How many digits are in a DCU account number?

DCU account numbers always consist of 11 digits.

What can I do if I can’t find my DCU account number online?

If you can’t find your account number online, you can check your statements, checks, contact DCU customer service, or visit a branch.

Is my DCU account number the same as my routing number?

No, your account number and routing number are different. The routing number identifies DCU, while the account number identifies your specific account.

Where is the account number located on a DCU check?

On a DCU check, the account number is the second set of numbers printed at the bottom.

Why is my DCU account number important?

Your DCU account number is essential for various banking activities like setting up direct deposit, making online payments, and transferring money.