Imagine this: You’re about to pay a bill online, and suddenly you realize you can’t remember your 1st Bank account number. Don’t worry! It happens to everyone. Finding your account number is usually a quick and easy process. This guide will show you several ways to locate your 1st Bank account number, so you can get back to your day in no time.

Why You Might Need Your 1st Bank Account Number

You use your 1st Bank account number for many important tasks, such as:

- Setting up direct deposit: Your employer needs your account number to deposit your paycheck directly into your account.1

- Paying bills online: You’ll need your account number to link your bank account to online bill pay services.

- Making wire transfers: To send or receive money via wire transfer, you’ll need your account number.

- Receiving payments: If someone wants to pay you electronically, they’ll need your account number.

- Verifying your identity: Sometimes, customer service representatives may ask for your account number to confirm your identity.

How to Find Your 1st Bank Account Number Online

1st Bank offers convenient online banking tools that make it easy to find your account number. Here’s how:

- Log in to your online banking account: Visit the 1st Bank website and log in using your username and password.2

- Locate your account information: Once logged in, look for a section called “Account Summary,” “Account Details,” or something similar. This section usually displays your account number along with other important information like your balance and transaction history.

Tips for Online Banking

- Keep your login information secure: Choose a strong password and don’t share it with anyone.

- Be cautious of phishing scams: 1st Bank will never ask for your login information via email or phone.3

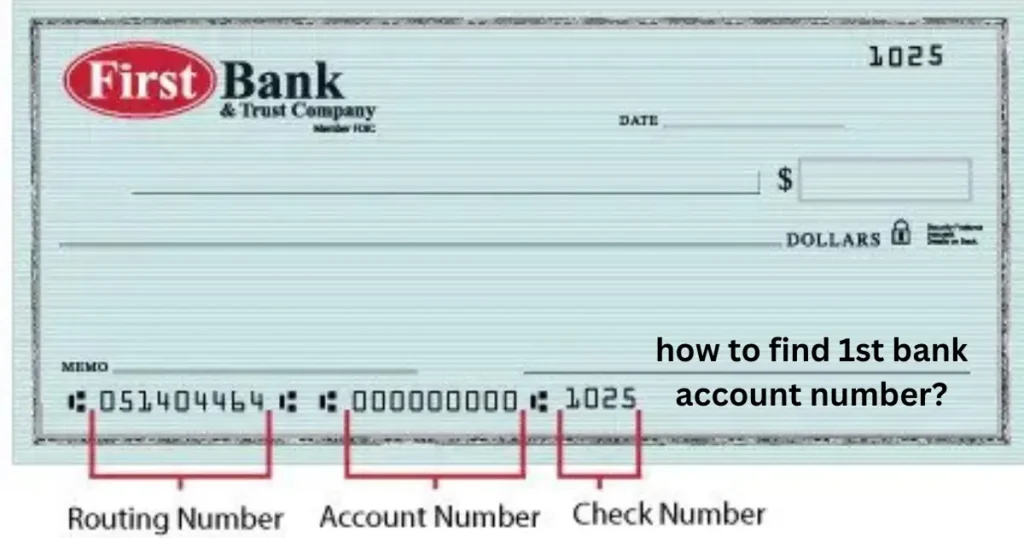

How to Find Your 1st Bank Account Number on Your Checkbook

If you have a 1st Bank checking account, you can easily find your account number on your checks. Here’s what to look for:

- The bottom of your check: You’ll see a series of numbers printed at the bottom of your check.

- Identify the account number: Your account number is the second set of numbers in this sequence.

| Check Element | Description |

|---|---|

| Routing number | The first set of numbers (usually 9 digits) |

| Account number | The second set of numbers (varies in length) |

| Check number | The third set of numbers (usually in the upper right corner) |

How to Find Your 1st Bank Account Number on Your Statements

Your monthly bank statements provide a detailed record of your account activity, including your account number.

- Review your paper statements: If you receive paper statements, you can find your account number printed on the statement.

- Access your statements online: Log in to your online banking account and go to the “Statements” or “Documents” section. You can then view and download your statements electronically.

How to Find Your 1st Bank Account Number on Your Mobile App

If you use the 1st Bank mobile app, you can quickly access your account number on your phone.

- Open the 1st Bank app: Log in to the app using your credentials.

- Find your account information: Look for a tab or menu option that says “Accounts,” “Account Summary,” or something similar. Your account number will be displayed there.

How to Find Your 1st Bank Account Number by Visiting a Branch

If you prefer in-person assistance, you can visit a 1st Bank branch to get help finding your account number.

- Bring identification: Make sure to bring a valid photo ID, such as a driver’s license or passport, to verify your identity.

- Speak to a bank representative: Explain that you need to find your account number and they will be happy to assist you.

How to Find Your 1st Bank Account Number by Calling Customer Service

If you can’t visit a branch or access online banking, you can call 1st Bank customer service for assistance.

- Find the customer service number: The phone number is usually located on the back of your debit card or on the 1st Bank website.

- Be prepared to verify your identity: The customer service representative will ask you security questions to confirm your identity before providing your account number.

How to Keep Your 1st Bank Account Number Secure

- Protect your documents: Store your checks, statements, and other financial documents in a safe place.

- Shred sensitive documents: Before discarding any documents that contain your account number, shred them to prevent identity theft.

- Monitor your account regularly: Check your account statements and transaction history frequently for any suspicious activity.

- Report any unauthorized transactions: If you notice any transactions that you didn’t make, contact 1st Bank immediately.

How to Find Your 1st Bank Account Number: A Summary

Locating your 1st Bank account number is a simple process with various options available. You can find it through online banking, on your checks and statements, via the mobile app, by visiting a branch, or by calling customer service. Remember to keep your account number secure and protect yourself from fraud.

By following these tips, you can ensure the safety of your financial information and enjoy the convenience of banking with 1st Bank.

FAQs

Is it safe to find my 1st Bank account number online?

Yes, it is generally safe to find your account number through 1st Bank’s official website or mobile app. Make sure you are using the legitimate 1st Bank platform and not a fraudulent website.

What should I do if I suspect fraudulent activity on my 1st Bank account?

If you notice any suspicious transactions or activity on your account, contact 1st Bank customer service immediately to report the issue and take necessary action.

Can I find my 1st Bank account number if I don’t have access to online banking?

Yes, you can find your account number through other methods such as checking your physical statements, checkbook, or by visiting a 1st Bank branch with proper identification.

What information do I need to provide to find my 1st Bank account number over the phone?

When calling customer service, be prepared to provide personal information to verify your identity, such as your full name, date of birth, address, and possibly the last four digits of your Social Security number.

Why is it important to keep my 1st Bank account number confidential?

Keeping your account number confidential helps protect you from identity theft and unauthorized access to your funds. Only share your account number with trusted individuals and institutions when necessary.