Imagine this: you’re at the ATM, ready to withdraw money for the weekend, but suddenly you realize you can’t remember your 4 digit account PIN! It’s a common situation that can cause a lot of stress.

But don’t worry, there are ways to recover or reset your PIN without putting your account at risk. This article will guide you through the process, offering helpful tips and precautions to ensure your financial information remains safe.

Understanding the Importance of Your 4 Digit Account PIN

Your 4 digit account PIN is a crucial piece of information that protects your money and personal details. It acts like a secret key that only you should know, preventing unauthorized access to your accounts. Whether it’s your bank card, credit card, or even your phone, this short code plays a big role in keeping your finances secure.

Why You Might Need to Find Your 4 Digit Account PIN

There are several reasons why you might find yourself needing to recover your PIN:

- You’ve forgotten it: It happens to the best of us! Our brains are busy with so much information that sometimes important details slip our minds.

- You wrote it down but can’t find it: Maybe you kept a record of your PIN for safekeeping, but now you can’t locate it.

- You suspect someone else knows your PIN: If you think your PIN has been compromised, it’s crucial to change it immediately.

How to Find Your 4 Digit Account PIN: Safe and Secure Methods

If you’ve forgotten your 4 digit account PIN, don’t panic. Here are some reliable and secure methods to recover or reset it:

Contact Your Bank or Financial Institution

- Call customer service: Most banks have a dedicated customer service line for PIN-related issues. Be ready to provide your account information and answer security questions to verify your identity.

- Visit a branch in person: If you prefer face-to-face interaction, visit your local bank branch with your ID and account details. They can guide you through the PIN recovery or reset process.

Use Online Banking Features

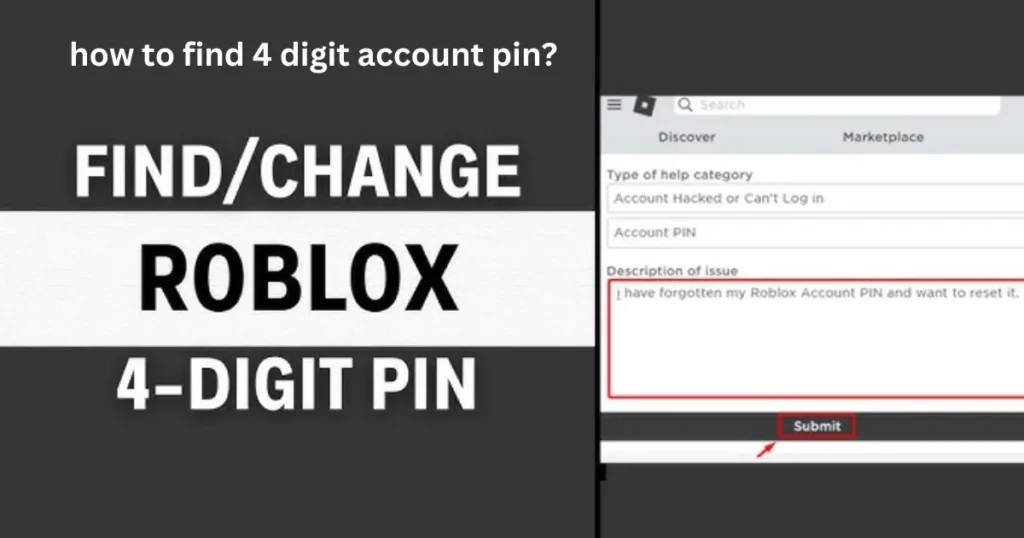

- “Forgot PIN” option: Many banks offer a “Forgot PIN” or “Reset PIN” option on their websites or mobile apps. Follow the instructions, which usually involve verifying your identity through email or text message.

- Security questions: You might be asked to answer security questions you set up when you opened the account. This helps confirm your identity before granting access to your PIN.

Check Your Records

- Look for written records: If you have a habit of writing down important information, carefully check your notebooks, diaries, or any other place where you might have recorded your PIN.

- Review old documents: Sometimes, your PIN might be mentioned in the initial paperwork you received when you opened the account.

Important Note: Never share your PIN with anyone, including bank staff or family members. A legitimate bank representative will never ask for your full PIN.

Protecting Your 4 Digit Account PIN: Best Practices

Preventing a PIN-related problem is always better than having to solve one. Here are some simple but effective ways to protect your PIN:

Choose a Strong PIN

- Avoid obvious sequences: Don’t use easily guessable patterns like “1234” or “0000”.

- Don’t use personal information: Stay away from birth dates, anniversaries, or phone numbers.

- Mix it up: Use a combination of numbers that are easy for you to remember but hard for others to guess.

Keep Your PIN Confidential

- Memorize it: The best way to protect your PIN is to memorize it and avoid writing it down.

- Shield it when entering: When using your PIN at an ATM or POS terminal, cover the keypad with your hand to prevent anyone from seeing it.

- Change your PIN regularly: It’s a good idea to change your PIN periodically to enhance security.

Be Alert for Suspicious Activity

- Monitor your accounts: Regularly check your bank statements and transaction history for any unauthorized activity.

- Report suspicious emails or calls: Be wary of phishing attempts or calls from individuals claiming to be bank representatives asking for your PIN.

- Use secure ATMs: Avoid using ATMs in isolated or poorly lit areas.

Additional Tips for 4 Digit Account PIN Security

Here are some extra tips to help you maintain the security of your 4 digit account PIN:

- Enable two-factor authentication: Add an extra layer of security to your online accounts by enabling two-factor authentication.

- Use a password manager: If you struggle to remember multiple PINs and passwords, consider using a reputable password manager to store them securely.

- Stay informed about security threats: Keep up-to-date with the latest security threats and scams by regularly checking your bank’s security alerts and advice.

Do’s and Don’ts of 4 Digit Account PIN Security

| Do | Don’t |

|---|---|

| Memorize your PIN | Write your PIN down |

| Change your PIN regularly | Use easily guessable sequences (e.g., 1234) |

| Shield the keypad when entering your PIN | Share your PIN with anyone |

| Monitor your accounts for unusual activity | Respond to suspicious emails or calls |

| Use strong and unique PINs for each account | Use the same PIN for multiple accounts |

What to Do If You Suspect Your PIN is Compromised

| Situation | Action to Take |

|---|---|

| You suspect someone knows your PIN | Change your PIN immediately through online banking or by contacting your bank. |

| You see unauthorized transactions on your account | Report it to your bank immediately. |

| You lose your card or it is stolen | Contact your bank immediately to block your card and request a new one. |

| You receive a suspicious email or call asking for your PIN | Do not provide any information. Report it to your bank. |

Conclusion: Taking Control of Your 4 Digit Account PIN Security

Your 4 digit account PIN is a small but mighty code that plays a vital role in protecting your financial information. By understanding the importance of PIN security and following the safe practices outlined in this article, you can minimize the risk of unauthorized access to your accounts.

Remember to choose strong PINs, keep them confidential, and remain vigilant against potential threats. If you ever need to find your PIN, utilize the secure methods provided by your bank or financial institution. By taking these steps, you can confidently manage your finances and enjoy peace of mind knowing your money is safe.

FAQs

Can I find my 4 digit account PIN online without contacting my bank?

It depends on your bank. Some banks offer online PIN recovery options through their website or mobile app, while others require you to contact customer service for security reasons.

What should I do if I can’t remember the answers to my security questions?

Contact your bank’s customer service. They may have alternative ways to verify your identity and help you reset your PIN.

Is it safe to use a password manager to store my 4 digit account PIN?

Reputable password managers use strong encryption to protect your information.3 However, it’s crucial to choose a trusted provider and use a strong master password to access the password manager.

How often should I change my 4 digit account PIN?

Security experts recommend changing your PIN every 3 to 6 months to enhance security and reduce the risk of unauthorized access.

What should I do if my card is lost or stolen?

Report the loss or theft to your bank immediately. They will block your card and issue a new one with a new PIN.