Imagine you run a small bookstore. You love when customers buy books, but sometimes, they don’t pay right away. They promise to pay later, and you keep track of this owed money as “accounts receivable.” But what happens if some people never pay? That’s where the “allowance for doubtful accounts” comes in. It helps you plan for those situations.

This article will guide you through the process of figuring out this important number at the end of the year. We’ll use simple terms and examples so you can understand it easily, even if you’re not an accounting expert.

Understanding Accounts Receivable and Doubtful Accounts

When you sell something to a customer and they don’t pay immediately, the amount they owe you is recorded as accounts receivable on your balance sheet. It’s an asset because it represents money you expect to receive in the future.

However, there’s always a risk that some customers won’t pay their debts. These unpaid amounts are called bad debts. To account for this, businesses use an allowance for doubtful accounts. This is like a safety net that reduces your accounts receivable to a more realistic amount you expect to collect.

Why Calculate the Allowance for Doubtful Accounts?

Figuring out the allowance for doubtful accounts is important for a few reasons:

- Accurate Financial Reporting: It gives you a truer picture of your business’s financial health.

- Better Decision Making: It helps you make smart choices about things like giving credit to customers.

- Compliance with Accounting Rules: It follows the rules accountants have to stick to.

Methods to Calculate the Allowance for Doubtful Accounts

There are two main ways to find the allowance for doubtful accounts:

Percentage of Accounts Receivable Method

This method estimates bad debt based on a percentage of your total accounts receivable.

Example:

Let’s say your bookstore has $10,000 in accounts receivable at the end of the year. Based on past experience, you estimate that 2% of this amount might not be collected.

Calculation:

Allowance for doubtful accounts = $10,000 x 2% = $200

This means you would set aside $200 as an allowance for potential bad debts.

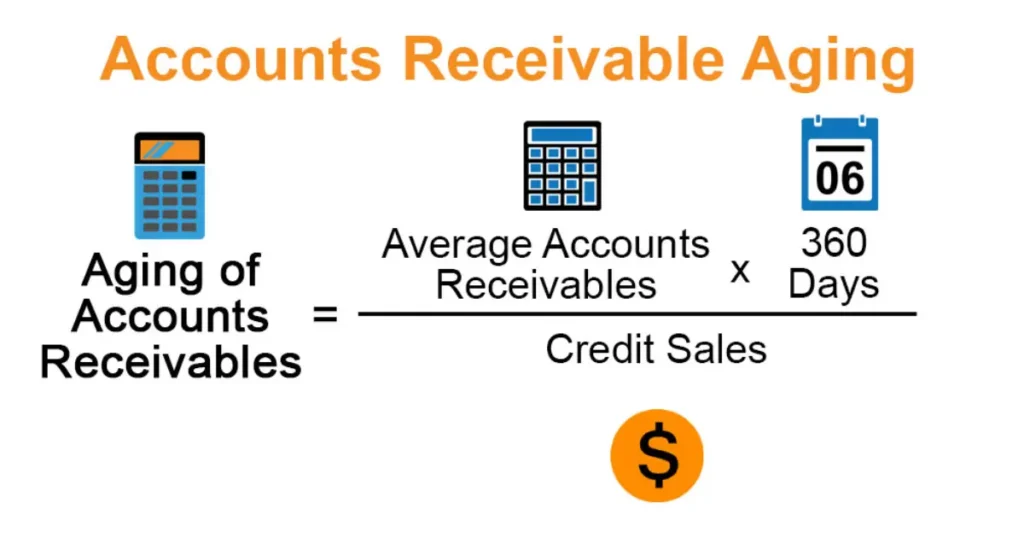

Aging of Accounts Receivable Method

This method is a bit more detailed. It looks at how old your outstanding invoices are. The older an invoice, the higher the chance it won’t be paid.

Example:

| Age of Invoice | Amount | Estimated Uncollectible (%) | Allowance for Doubtful Accounts |

|---|---|---|---|

| 0-30 days | $5,000 | 1% | $50 |

| 31-60 days | $3,000 | 3% | $90 |

| 61-90 days | $1,500 | 5% | $75 |

| Over 90 days | $500 | 10% | $50 |

| Total | $10,000 | $265 |

As you can see, the older the invoices, the higher the percentage used to estimate uncollectible amounts. This method gives you a more accurate allowance for doubtful accounts because it considers the age of your receivables.

How to Find the Allowance for Doubtful Accounts at Year-End: Step-by-Step

- Choose a Method: Decide whether you’ll use the percentage of accounts receivable method or the aging of accounts receivable method. Consider your business needs and the complexity of your accounts receivable.

- Gather Data: Collect all necessary information, including your total accounts receivable balance and the age of each outstanding invoice.

- Calculate the Allowance:

- Percentage of Accounts Receivable: Multiply your total accounts receivable by the estimated uncollectible percentage.

- Aging of Accounts Receivable: Calculate the allowance for each age category and then add them up.

- Record the Adjustment: Make the necessary adjustments in your accounting records to reflect the calculated allowance for doubtful accounts. This usually involves a debit to “bad debt expense” and a credit to “allowance for doubtful accounts.”

Tips for Accurate Calculation

- Review Historical Data: Look at your past bad debt experiences to get an idea of what percentage to use for estimating uncollectible accounts.

- Consider Industry Trends: Research typical bad debt percentages in your industry to see if your estimates are in line with others.

- Use Accounting Software: Many accounting software programs have features that can help you calculate and track your allowance for doubtful accounts.

- Consult with an Accountant: If you’re unsure about which method to use or how to make the necessary accounting adjustments, seek professional advice from an accountant.

Impact of Allowance for Doubtful Accounts on Financial Statements

The allowance for doubtful accounts affects both your balance sheet and income statement:

- Balance Sheet: It reduces the value of your accounts receivable to its net realizable value, which is the amount you realistically expect to collect.

- Income Statement: It creates a bad debt expense, which reflects the cost of doing business on credit.

By accurately calculating and recording the allowance for doubtful accounts, you ensure that your financial statements provide a true and fair view of your business’s financial position and performance.

Summary

The allowance for doubtful accounts is a crucial element of accurate financial reporting. By understanding the different methods to calculate this allowance and following the steps outlined in this article, you can ensure that your business is well-prepared for potential bad debts. Remember to choose the method that best suits your needs and regularly review your estimates to maintain accuracy.

FAQs

Is the allowance for doubtful accounts an asset?

No, the allowance for doubtful accounts is a contra asset account. This means it reduces the value of an asset, in this case, accounts receivable.

What is the difference between the percentage of sales method and the percentage of accounts receivable method?

The percentage of sales method estimates bad debt expense based on a percentage of credit sales, while the percentage of accounts receivable method estimates the allowance for doubtful accounts based on a percentage of outstanding receivables.

Why is it important to adjust the allowance for doubtful accounts at year-end?

Adjusting the allowance for doubtful accounts at year-end ensures that your financial statements accurately reflect the amount of accounts receivable you realistically expect to collect.

Can I change the method I use to calculate the allowance for doubtful accounts?

Yes, you can change the method you use, but you should do so consistently and disclose the change in your financial statement footnotes.

Where can I find more information about accounting for doubtful accounts?

You can find more information in accounting textbooks, online resources, and by consulting with an accounting professional.