Imagine you’re putting together a puzzle. You have all the pieces, but one tiny piece is missing, and it’s driving you crazy! That’s what finding a small discrepancy, like $90, in your account reconciliation can feel like. Account reconciliation is like making sure your records match your bank statement.

It’s about checking that the money you think you have actually matches the money you have in your bank account. Even a small difference, like $90, can be a sign of a bigger problem. This article will show you how to become a financial detective and find that missing puzzle piece!

Why is Account Reconciliation Important?

Account reconciliation is a bit like checking your pockets to make sure you have all your money. It’s a crucial process for businesses and individuals alike. Here’s why:

- Accuracy: It helps ensure your financial records are correct and reflect the actual state of your finances.

- Fraud Prevention: Regularly reconciling your accounts can help you spot unusual activity and prevent fraud.

- Informed Decision Making: Accurate financial data empowers you to make smart choices about spending, saving, and investing.

- Peace of Mind: Knowing your accounts are reconciled gives you confidence and peace of mind about your financial situation.

Common Causes of Discrepancies

Before we dive into the “how-to,” let’s look at some common reasons why those pesky discrepancies pop up:

- Typos: Everyone makes mistakes! A simple typo when entering a transaction can throw off your balance.

- Missing Transactions: Sometimes, transactions get overlooked or forgotten, leading to a mismatch.

- Timing Differences: It takes time for some transactions, like checks, to clear your bank account, which can create temporary discrepancies.

- Bank Errors: While rare, banks can make mistakes too!

- Unauthorized Transactions: Keep an eye out for any transactions you don’t recognize, as they could indicate fraud.

How to Find a $90 Discrepancy in Account Reconciliation

Now, let’s put on our detective hats and get to work! Here’s a step-by-step guide to help you find that $90 discrepancy:

Gather Your Tools

You’ll need:

- Your Bank Statement: This shows all the transactions that went through your bank account during a specific period.

- Your Financial Records: This could be your checkbook register, accounting software, or spreadsheets where you track your income and expenses.

- A Calculator: To double-check the math!

- A Highlighter: To mark transactions as you review them.

Start with the Obvious

- Check for Typos: Carefully review all the entries in your financial records and on your bank statement. Look for any errors in the amounts, dates, or descriptions.

- Look for Missing Transactions: Compare your records to your bank statement line by line. Are there any transactions on your statement that aren’t in your records, or vice versa?

- Verify Starting and Ending Balances: Make sure the starting balance in your records matches the ending balance from the previous reconciliation period. Also, check that the ending balance in your records matches the ending balance on your bank statement.

Dive Deeper

If you haven’t found the $90 discrepancy yet, it’s time to dig a little deeper.

- Review Recent Transactions: Focus on transactions around the time the discrepancy appeared. Sometimes, a transaction from the previous month might not have cleared until the current month.

- Check for Duplicate Transactions: Make sure you haven’t recorded the same transaction twice in your records.

- Reconcile Deposits and Withdrawals Separately: Sometimes, it helps to reconcile all deposits first and then move on to withdrawals. This can make it easier to spot errors.

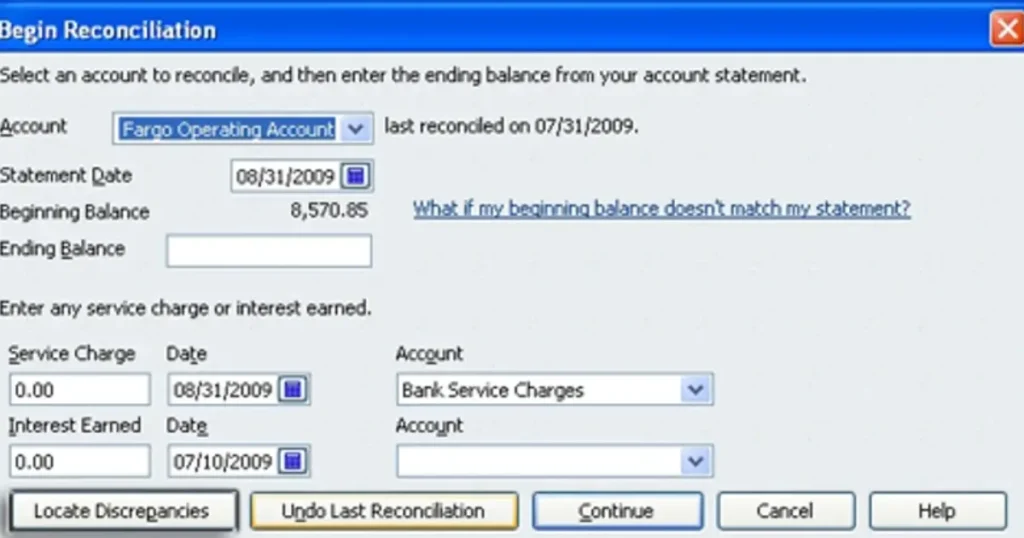

Use Technology to Your Advantage

- Accounting Software: If you use accounting software, it often has built-in reconciliation features that can help you identify discrepancies.7 Many programs generate reports that highlight unreconciled transactions.

- Spreadsheet Software: Even if you don’t use accounting software, a simple spreadsheet can be a powerful tool. You can use it to list your transactions, sort them, and use formulas to calculate totals and identify differences.

Don’t Give Up!

Finding a small discrepancy can be like searching for a needle in a haystack, but don’t give up! Take breaks if you need to, and come back to it with fresh eyes. Sometimes, just stepping away for a while can help you see things you missed before.

Example: Finding a $90 Discrepancy

Let’s say your bank statement shows an ending balance of $1,500, but your records show an ending balance of $1,590. Here’s how you might approach finding the $90 difference:

- Check for obvious errors: Review your records and bank statement for typos or missing transactions.

- Focus on recent transactions: Look at the transactions that occurred around the time the discrepancy appeared. Did a check you wrote for $90 clear later than you expected?

- Use a spreadsheet: Create a simple spreadsheet to list all your transactions and compare them to your bank statement. This can help you visualize the data and identify any discrepancies.

| Date | Description | Bank Statement | Your Records |

|---|---|---|---|

| 01/01/2025 | Starting Balance | $1,000 | $1,000 |

| 01/05/2025 | Paycheck | $500 | $500 |

| 01/10/2025 | Rent Payment | -$400 | -$400 |

| 01/15/2025 | Grocery Store | -$100 | -$100 |

| 01/20/2025 | Check #123 | -$90 | $0 |

| 01/25/2025 | Utility Bill | -$50 | -$50 |

| 01/31/2025 | Ending Balance | $1,500 | $1,590 |

By organizing your information like this, you might quickly realize that you forgot to record check #123 for $90 in your records.

Tips for Accurate Account Reconciliation

- Reconcile Regularly: The more often you reconcile your accounts, the easier it is to find and fix discrepancies.8 Aim for monthly reconciliation, or even more frequently if you have a high volume of transactions.

- Be Organized: Keep your financial records neat and organized. This will make it much easier to review them and spot errors.

- Use a Consistent Method: Develop a standard process for reconciling your accounts and stick to it. This will help ensure you don’t miss any steps.

- Separate Duties: If possible, have different people responsible for recording transactions and reconciling accounts. This can help reduce the risk of errors and fraud.

When to Seek Help

If you’ve tried all the steps above and still can’t find the discrepancy, or if you suspect fraud, don’t hesitate to seek help from a professional accountant or bookkeeper. They have the expertise to identify complex issues and provide guidance.

Conclusion

Finding a $90 discrepancy in your account reconciliation might seem like a small matter, but it’s an important part of maintaining accurate financial records. By following the steps outlined in this article, you can become a financial detective and track down those missing puzzle pieces.

Remember to reconcile regularly, stay organized, and use technology to your advantage. With a little patience and persistence, you can ensure your financial records are always accurate and up-to-date.

FAQs

Can small discrepancies be ignored?

While it might be tempting to ignore a small discrepancy, it’s important to investigate every difference, no matter how small. Even a small error could be a sign of a bigger problem.

What should I do if I suspect fraud?

If you suspect fraudulent activity in your account, contact your bank immediately. They can help you investigate the issue and take steps to protect your account.

Is it necessary to reconcile every account?

Yes, it’s a good practice to reconcile all your accounts, including checking accounts, savings accounts, credit card accounts, and investment accounts.

How can I prevent future discrepancies?

You can reduce the risk of future discrepancies by reconciling your accounts regularly, being organized, and using a consistent method. You can also use accounting software to automate some of the reconciliation process.

What are some common signs of fraud to watch out for?

Common signs of fraud include unauthorized transactions, missing deposits, and changes to your personal information on your account. If you notice anything suspicious, contact your bank immediately.