Imagine you’re sending money to a friend, paying a bill online, or setting up direct deposit for your paycheck. You’ll need a special number called a routing number to make these transactions happen.

Think of it as a secret code that tells banks where to find your account. But where do you find this important number? Don’t worry, it’s actually quite simple! This guide will show you different ways to locate your checking account routing number quickly and easily.

What is a Checking Account Routing Number?

A routing number is a nine-digit code used to identify a specific financial institution in the United States. It acts like an address for your bank, allowing money to be sent to and from your account accurately. Each bank has a unique routing number, which is essential for various transactions like:

- Direct deposit: Getting your paycheck sent straight to your account.

- Wire transfers: Sending or receiving money electronically between banks.

- Paying bills online: Authorizing payments from your checking account.

- Setting up automatic payments: Scheduling regular payments for things like rent or utilities.

How to Find Your Checking Account Routing Number

There are several places where you can find your checking account routing number. Let’s look at the most common methods:

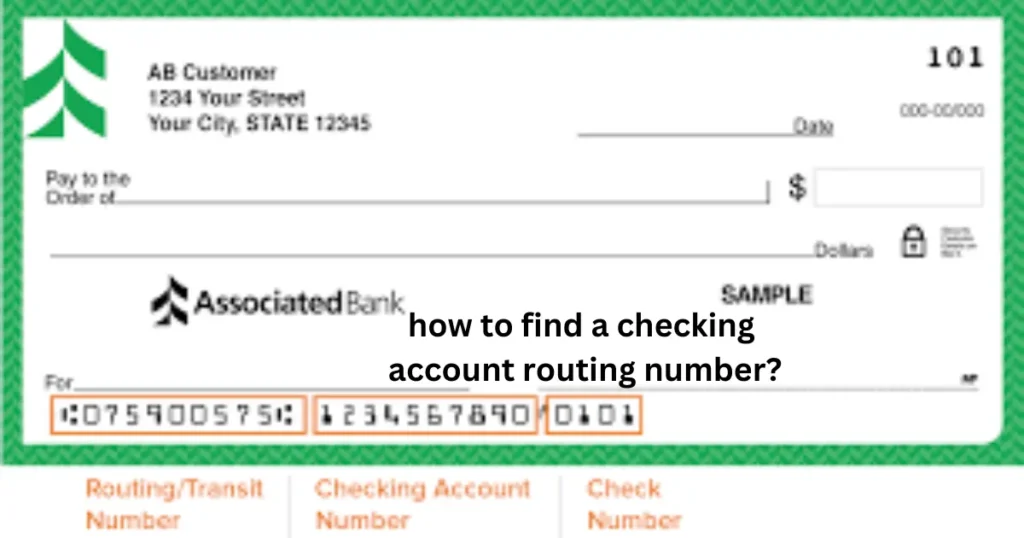

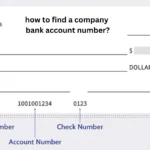

Check Your Checks

One of the easiest ways to find your routing number is by looking at your checks. You’ll find it printed at the bottom left corner of your check.

| Feature | Location on a Check |

|---|---|

| Routing Number | Bottom left corner |

| Account Number | Bottom middle |

| Check Number | Top right corner |

Online Banking

Most banks allow you to access your account information online. Here’s how to find your routing number through online banking:

- Log in: Visit your bank’s website or use their mobile app to log in to your account.

- Find account details: Look for a section called “Account Information,” “Account Details,” or something similar.

- Locate routing number: Your checking account routing number will be listed along with other details like your account number and balance.

Bank Statements

Your monthly bank statement also contains your routing number. It’s usually printed on the top or bottom of the statement, along with your account information.

Contact Your Bank

If you’re having trouble finding your routing number, you can always contact your bank directly.

- Call customer service: Find the customer service number on the back of your debit card or on the bank’s website.

- Visit a branch: Go to your local bank branch and ask a teller for assistance.

Official Bank Website

Many banks list their routing numbers on their official websites, often in the “About Us” or “Contact Us” sections. You can also sometimes find it in the FAQs or Help Center.

Understanding Routing Numbers: Common Questions

What if I have multiple checking accounts with the same bank?

Even if you have multiple checking accounts with the same bank, each account will have a unique routing number.

Are routing numbers the same for different branches of the same bank?

No, routing numbers can vary between different branches of the same bank, especially if those branches are in different states.

Can I use my checking account routing number for international transfers?

No, routing numbers are only used for domestic transfers within the United States. For international transfers, you’ll need a SWIFT code, which is a similar identifier for banks worldwide.

What should I do if I think my routing number has been compromised?

If you suspect your routing number has been compromised, contact your bank immediately to report the issue and take necessary precautions.

Why is it important to keep my routing number secure?

Your routing number, along with your account number, gives access to your funds. Keeping it secure helps prevent unauthorized transactions and protects your money.

Using Your Checking Account Routing Number Safely

While routing numbers are printed on checks and available online, it’s crucial to keep them secure. Avoid sharing your routing number with untrusted sources or over unsecured channels like email or social media.

Remember, your bank will never ask for your full routing number or account number via email or phone. If you receive such a request, it’s likely a scam.

In Conclusion

Knowing how to find your checking account routing number is essential for managing your finances effectively. Whether you’re setting up direct deposit, paying bills online, or transferring money, having this information readily available makes banking easier and more convenient.

By using the methods outlined in this guide, you can quickly locate your routing number and ensure your transactions go smoothly. Always prioritize the security of your banking information and take necessary precautions to protect your financial assets.

FAQs

How can I find my routing number without a check?

You can find your routing number through online banking, on your bank statement, by contacting your bank, or by checking the official bank website.

Is my routing number the same as my account number?

No, your routing number and account number are different. The routing number identifies your bank, while the account number identifies your specific account within that bank.

Where is the routing number located on a deposit slip?

The routing number is usually located at the bottom left corner of a deposit slip, similar to its placement on a check.

Do credit cards have routing numbers?

No, credit cards do not have routing numbers. Routing numbers are specifically associated with bank accounts.

Can I find my routing number on my mobile banking app?

Yes, most mobile banking apps display your routing number along with your other account details.