Imagine this: you’re doing your taxes and suddenly remember an old bank account you haven’t used in years. Maybe you moved, got a new job, or simply forgot about it. Now, you need to track it down, but where do you even begin?

Don’t worry, it’s a common situation! Many people have forgotten about old accounts. This guide will give you a clear path to follow, showing you how to find a closed bank account, even if you remember very little about it. We’ll look at different methods you can use, the information you might need, and some helpful tips to make the process easier. Let’s get started!

Methods to Find a Closed Bank Account

There are several ways to find a closed bank account. The best method for you will depend on what you remember about the account and the resources available to you.

Contact the Bank Directly

This is often the most straightforward way to find a closed bank account.

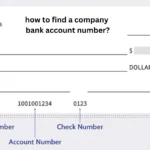

- Gather your information: Before contacting the bank, gather any relevant information you remember about the account, such as the bank’s name, the approximate date of closure, and your account number (if you have it). Even partial information can be helpful.

- Reach out to customer service: Contact the bank’s customer service department. You can usually find their contact information on the bank’s website. Explain that you are trying to locate a closed account and provide them with the information you have.

- Verify your identity: The bank will likely ask you to verify your identity to protect your privacy and security. Be prepared to provide identification documents like your driver’s license or social security number.

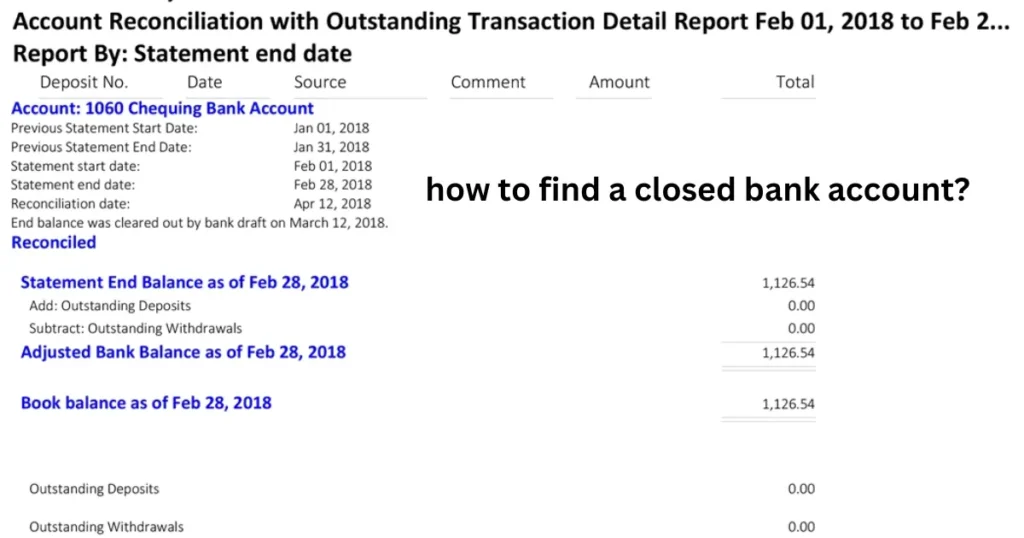

Review Your Financial Records

Old bank statements, tax returns, and checkbooks can contain valuable clues about your closed account.

- Check your files: Look through your filing cabinets, boxes of old documents, or even your computer for any records related to the account.

- Look for account numbers and transaction history: These records might contain your account number, the bank’s name, and even the date the account was closed.

Check Your Credit Report

Your credit report might list your old bank accounts, even if they are closed.

- Obtain your credit report: You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

- Review the report carefully: Look for any accounts listed that you don’t recognize or remember closing. This could lead you to your closed bank account.

Use Online Search Engines

If you remember the bank’s name but can’t find their contact information, a simple online search can help.

- Search for the bank: Use a search engine like Google, Bing, or DuckDuckGo to search for the bank’s name. This should lead you to their website, where you can find their contact information and potentially access online banking tools that might show your account history.

Check with the FDIC

If you suspect the bank has closed down completely, the Federal Deposit Insurance Corporation (FDIC) can help.

- Visit the FDIC website: The FDIC keeps records of failed banks. You can search their database to see if your bank was closed and find information about any successor institutions that might have taken over its accounts.

What Information Do You Need to Find a Closed Bank Account?

The more information you have about the closed account, the easier it will be to find it. Here are some key pieces of information that can help:

- Bank name: This is crucial for contacting the bank or searching for it online.

- Account number: This is a unique identifier for your account and can significantly speed up the search process.

- Dates of operation: Knowing when you opened and closed the account can help narrow down your search in records and statements.

- Social Security number: This is often used to verify your identity when contacting a bank.

- Types of accounts: Knowing whether it was a checking, savings, or other type of account can be helpful.

| Information | Importance |

|---|---|

| Bank Name | Essential for contacting the bank or searching online. |

| Account Number | Unique identifier that can speed up the search. |

| Dates of Operation | Helps narrow down your search in records and statements. |

| Social Security Number | Used to verify your identity. |

| Account Type | Provides additional details that can help in identification. |

Tips for Finding a Closed Bank Account

Here are some additional tips to help you in your search:

- Be persistent: Finding a closed bank account might take time and effort. Don’t give up easily.

- Keep accurate records: Always keep good records of your financial accounts, including account numbers, bank names, and contact information. This will make it much easier to find any account in the future.

- Consider professional help: If you are having trouble finding a closed bank account, you might consider seeking help from a financial advisor or accountant.

Why Might You Need to Find a Closed Bank Account?

There are various reasons why you might need to locate a closed bank account. Some common reasons include:

- Tax purposes: You might need information from the account for tax filing.

- Legal reasons: You might need account information for legal proceedings.

- Unclaimed funds: There might be unclaimed funds in the account that you can recover.

- Estate settlement: You might need to locate the account as part of settling a deceased person’s estate.

| Reason | Description |

|---|---|

| Tax Purposes | Information needed for tax filing. |

| Legal Reasons | Account details required for legal proceedings. |

| Unclaimed Funds | Possibility of recovering unclaimed money. |

| Estate Settlement | Locating the account for a deceased person’s estate. |

How to Find a Closed Bank Account: Summary and Key Takeaways

Finding a closed bank account can seem daunting, but it’s often a manageable process with the right approach. By contacting the bank, reviewing your records, checking your credit report, and using online resources, you can increase your chances of success. Remember to gather as much information as possible about the account before you begin your search.

By following these steps and remaining persistent, you can successfully locate your closed bank account and access any necessary information.

FAQs

How can I find out if a bank account I had as a child still exists?

If you had a bank account as a child, you can try contacting the bank directly or searching your old records. If the account was opened under a custodial agreement with a parent or guardian, you may need their assistance to access information.

What happens to the money in a closed bank account?

When a bank account is closed, any remaining funds are typically returned to the account holder. However, if the account holder cannot be located, the funds may eventually be turned over to the state as unclaimed property.

Can I reopen a closed bank account?

Generally, you cannot reopen a closed bank account. However, you may be able to open a new account with the same bank.

Is there a fee to find a closed bank account?

Banks typically do not charge a fee to help you locate a closed account. However, there may be fees associated with obtaining certain documents, such as old statements.

How long does a bank keep records of closed accounts?

Banks have different policies on how long they keep records of closed accounts. Generally, they are required to keep records for a certain number of years to comply with regulations.